Essential Tools and Services for Freelancers in Germany

Top Takeaways From This Post

Last updated on January 23rd, 2023 at 12:41 pm

Do you want to start your own self-employment in Germany soon? This article covers an overview of the most important tools and services for freelancers in Germany for your business.

Managing a business anywhere comes with a host of challenges. It’s even more complicated in a foreign country where you have to deal with an entirely new ecosystem.

On top of that, Germany is notorious for being a bureaucratic madhouse, at least within the expat community. There are nearly not enough user manuals to help foreigners navigate through the complicated German tax, insurance and rigid red-tape systems.

However, if you look hard enough there are some freelance-friendly service providers in Germany.

Here are some highly recommended essential tools and services for freelancers in Germany to make your personal and work life in Germany safe and stress-free.

Disclaimer: This page may include affiliate links. They do not cost you anything but I might earn a small income if you decide to use one of my recommended partners. Thank you for your support to help keep this platform growing!

1. Financial Services for Freelancers

1.1) Online Tax-Filing Tools

One way or the other, your tax-related documents have to get to your local tax office.

The only caveat is that the German tax system is not easy – definitely not for self-employed people. So how do you know what “Finanzamt” needs from you?

For many, filing a tax return is a tedious and above all time-consuming task. Even if you start on time and make the right preparations, the whole thing could still end in chaos.

You can make it even easier for yourself to submit your advance VAT return, EÜR, or annual income tax declaration with just a few clicks directly from a dedicated English tax filling tool for freelancers such as Sorted!

You don’t even need an ELSTER certificate – Sorted submits your tax reports directly to the tax office.

You can track your income and expenses with Sorted for free. It prepares your tax reports based on your data.

You can file your German freelancer taxes as a Kleinunternehmer for as little as €80 per year.

Read my full step by step tutorial of Sorted. Or watch this video walkthrough instead.

Click here to sign up with Sorted and submit your German freelancer taxes effortlessly in ENGLISH

1.2) Accounting and Invoicing Software

Invoicing clients and getting paid regularly is one of the most essential parts of freelancing.

You can generate invoices automatically using an invoicing program or accounting software. In addition, invoice software offers many functions to simplify the processes such as

- Automatic offer and invoice creation

- Getting paid through Paypal and other online services,

- Integration with your business bank account,

- Automatic generation of late fee templates (Mahnung), and

- A number of email templates and auto texts

- Basic to advanced bookkeeping features

SevDesk offers user interfaces in English and German (plus several other EU languages).

Read my roundup of English invoicing and accounting software in Germany here.

1.3) Business Bank Account

If you become self-employed as a freelancer or sole proprietor, you can theoretically use your private account for business activities. However, this is generally not recommended, as you can quickly lose track of your private and business finances when managing your self-employment in Germany.

There are a number of options available for freelancers in Germany.

You can choose a traditional bank with a vast national network in Germany with branches in nearly every city. This certainly makes it easier to conduct day-to-day business for the old school self-employed people.

- Commerzbank Startkonto (English)

- Postbank

- Targobank

But you may have an online business or simply prefer to do your transactions online. Well now that we’ve arrived in the 21st century, Germany has a host of online banks now. Freelancers in Germany can easily open online business bank accounts with

Related: How to Choose a Business Account as a Freelancer in Germany (2020 Edition)

2. IT Services for Freelancers in Germany

2.1) Web Hosting Service

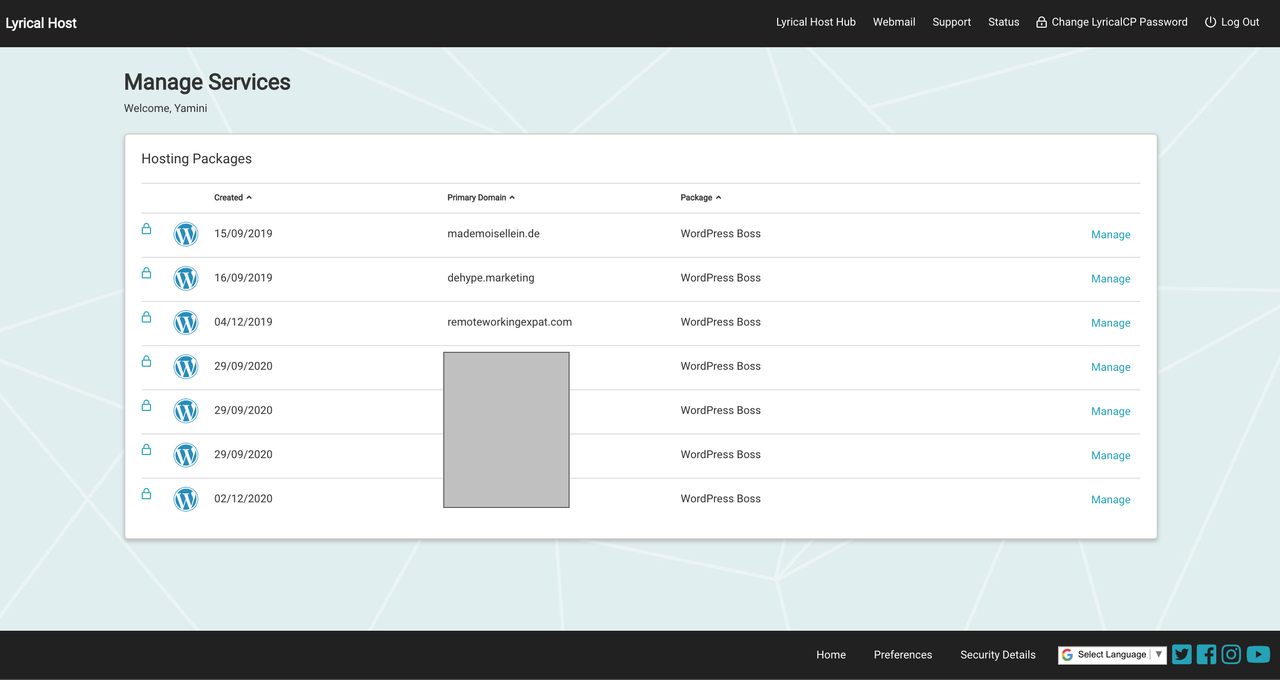

I switched to a UK-based web hosting company – Lyrical Host after going through a hellish web hosting experience with a German provider.

My websites have been with them since Sept 2019 with only positive experiences. I was so impressed by the responsive, helpful and approachable tech support that in 2020, I upgraded my plan and currently host seven websites with them.

The C-panel of Lyrical Host is in English by default. There’s an option to switch to a number of languages. Lyrical Host might be on the higher end, but considering all that is included in the cost-plus of their fantastic tech support, they are worth every penny.

Get more details about Lyrical’s Host’s plans here

2.2) Domain Hosting Service

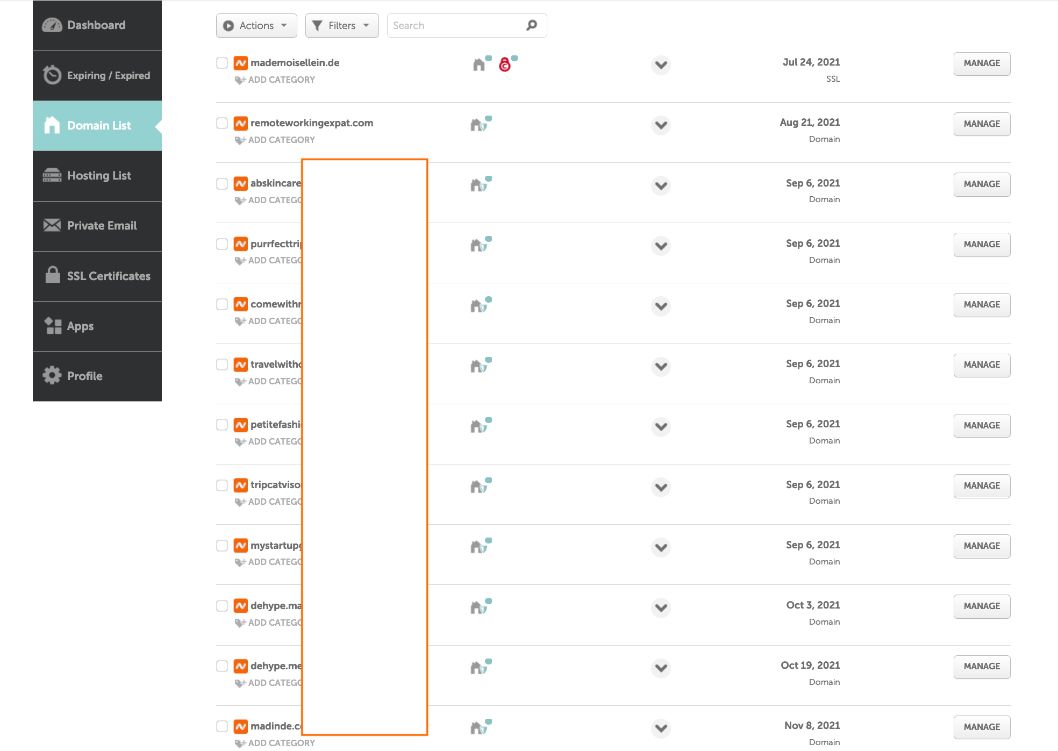

Any experienced website owner will tell you never to host your domain and website with the same provider.

This is why I use NameCheap as my trusted domain hosting provider. Currently, I host more than 10 domains with NameCheap.

I have been with them even longer than Lyrical Host and never had anything to complain about.

I always got quick support through their chat plus they have a vast knowledge base in simple English that has helped me troubleshoot any issues.

Click here to find a domain for your business website here with NameCheap.

2.3) VPN Service

A Virtual Private Network (VPN) offers you a secure, encrypted online browsing experience.

Freelancers often work from places with public wi-fi such as a coworking space or a cafe which runs a risk of compromising your online security.

However, with a VPN you can safely access your sensitive personal information such as your cloud storage, online bank account, online shops that store your credit card information, or work files. You can also encrypt your internet connection, and keep your browsing history private.

Namecheap’s VPN service offers outstanding value for money and a range of innovative features. They have servers in 50 countries, so you can choose where you want the connection to be from – including specific cities. This makes it super easy to access geo-restricted content or streaming platforms such as Netflix, Hulu, HBO Max etc.

NordVPN is one of the most popular and easy-to-use VPNs if you’re looking for peace of mind whenever you’re online. Plus it costs under 4 EUR per month!

3. Business Services for Freelancers

3.1) Translation Services

If you have to ever get contracts or legal documents translated you can use lingoking’s super easy online translation services.

You can simply book your desired translation via lingoking’s translation platform. Select a service, get a quote, and place your order! You can get a professional translation for your

3.2) Freelancing (Outsourcing) platforms

As a business owner, you can’t possibly do every single thing. You might need to create a website or write blog posts regularly. Or maybe brand it with some original graphics and logos.

Fiverr is an excellent platform to hire an expert for your work.

They have a large database of content creators, graphic designers, web developers, and voice artists in case you need to outsource when work gets too much.

Click here to hire a freelancer on Fiverr.

4. Insurances for Freelancers in Germany

4.1) Health Insurance

Let’s begin with the most essential insurance out there! Health insurance for freelancers is obligatory in Germany.

There are a number of private and public health insurance providers to choose from.

With public health insurance freelancers have to pay about 14%-16% of their gross monthly income. This makes it very expensive for low-earning or early-stage freelancers (for very basic coverage at that!).

A lot of freelancers in Germany, expats or locals, prefer private health insurance since it is considered a cheaper option of the two. It is also possible to tailor your own plan to get the kind of coverage you want or need – something that is very difficult to find in statutory health insurance in Germany.

Read More: Health Insurance for Freelancers in Germany

4.2) Personal/ Private Liability Insurances

In Germany, if you ever hurt someone or cause any damage, you have the legal obligation to compensate the other party.

Not only this. You can be held liable for an unlimited amount for any damages you cause. This means even a once-in-a-lifetime freak accident could potentially put you in a lifetime of debt.

It is no wonder that nearly 85% of the German population has personal liability insurance (Privathaftpflichtversicherung). This insurance protects you from the financial consequences of any unusual (or usual) accidents.

- Personal liability insurance: It covers third-party claims and safeguards you against any legal expenses if someone wrongfully accuses you of damaging their property. It is not necessary to buy a policy for every member of your family. In most policies, your spouse, as well as children, are also insured.

GetSafe is an expat-friendly private liability insurance provider based in Berlin and offers services in English.

- Dog liability insurance: If you are a dog owner, you need to buy dog liability insurance or Hundehaftpflichtversicherung to cover any accidental damages that your fur child could cause.

GetSafe offers affordable dog liability insurance in English.

- Car Insurance: If you plan to drive a car in Germany, the risks from driving have to be insured separately with Kfz-Versicherung.

4.3) Professional Liability Insurance

This is one of those insurances that you would need to assess internally. And very carefully.

Can your self-employment in Germany result in some kind of damage to your client (and other relevant parties)?

In Germany, just like a private person, companies (businesses) can also be held liable for damages caused to an unlimited extent. Professional liability insurance is, therefore, one of the most important insurances for freelancers in Germany.

Professional liability insurance covers losses incurred by third parties in the course of business activities. In addition, liability insurance for self-employed persons fends off unjustified claims.

Hiscox is a 100+ years old insurance provider specialising in professional liability insurance globally.

They insure freelancers and small and medium-sized companies with tailor-made coverage for their industries e.g.

Learn about professional liability insurance for your freelancer business!

4.4) Legal Protection Insurance

Legal protection insurance (Rechtsschutzversicherung) protects you from unexpected legal costs. Just like the above freelance liability insurance, this is voluntary as well.

However, if you are one of those people who keep getting in trouble, then this one might be totally worth it.

With Rechtsschutzversicherung you pay a monthly premium to your insurer and oblige them to save your arse whenever you find yourself in the middle of a shitstorm – such as a dispute with your neighbours from hell, or when you leave a libellous review for a business or get in a car accident.

The following companies offer legal protection (in German only!)

If you are looking for service in English, then GetSafe offers comprehensive private and professional legal protection insurance starting from 17.79 Euros per month.

So here are my top essentials that every expat freelancer in Germany should have in their toolkit. Did you have any other useful insurance for self-employment in Germany? What other products or services are a must-have for you? Let us know in the comments below.

One Comment

Pingback: