How to Create German VAT Invoice + FREE Invoice Templates

Top Takeaways From This Post

Last updated on December 23rd, 2022 at 10:19 pm

Are you an new freelancer in Germany? Read this post to learn how you can create German VAT Invoice correctly. Don’t forget to download FREE German invoice templates at the end of the post!

For any freelancer writing the first invoice is a special moment. I remember the first time when I was getting ready to send my first German VAT invoice ever.

I thought that it was going to be a straightforward affair.

But after my tax advisor returned my invoices because they were incorrectly formatted, I had to learn to create them in a legally acceptable form.

So in addition to the joy of the prospect of the first payment, many new international freelancers find themselves confused about how legally valid German VAT invoices must actually look like.

To help you get paid quickly, I have prepared a short guide on how to easily create a German VAT invoice that is compliant with Finanzamt’s requirements.

PS: Don’t forget to download FREE German invoice templates at the end of the post!

Disclaimer: This post contains affiliate links that may earn me a small commission, at no additional cost to you. I only recommend products I personally use and love, or think my readers will find useful.

1. Who Has to Write a VAT Invoice in Germany?

According to § 14 of the UStG an invoice is “any document used to settle a delivery or other service”. In addition, this paragraph defines exactly how and with what information you write an invoice.

In summary, every company that provides delivery or service to another company must write an invoice for it.

2. How to Write an Invoice in Germany?

In § 14 Abs. 4 UStG you will find the complete overview of all official German VAT invoice elements.

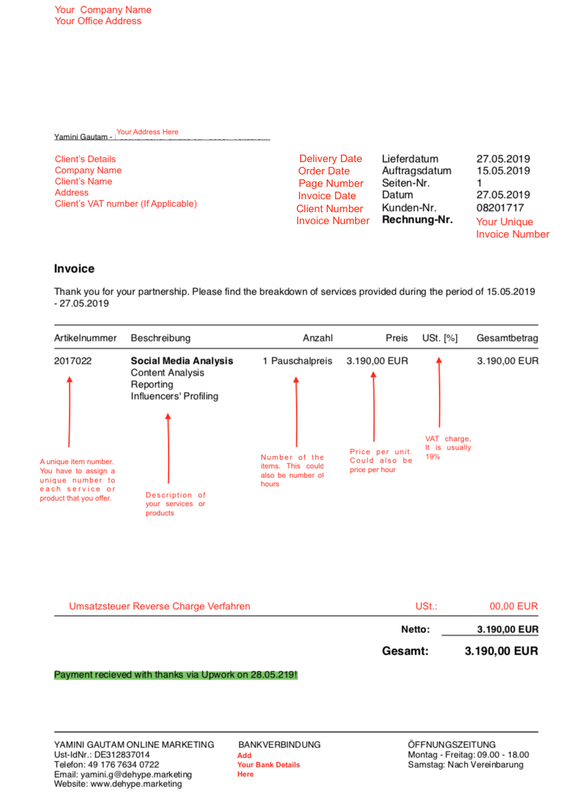

Here is an overview of all compulsory components of a German invoice:

- Name and address of your company

- Name and address of your client

- Your VAT number

- Client’s VAT number

- For customers from other EU countries their VAT identification number

- The date of issue (when was the invoice written)

- A one-off, consecutive invoice number (more details below)

- Quantity and type of products supplied or scope and type of other services

- Time of delivery or service

- The net amount and the related tax amount, the VAT charge and the gross amount

3. Additional Information That You Should Add to Your Invoice

Even if this is not a stipulated requirement, it is always worthwhile to title an invoice as “Invoice” or Rechnung.

This avoids misunderstandings and clearly separates invoices from your expenses, delivery notes, offers and orders.

Provide personal contact details such as your phone number or email address. It will make it easier for your clients to contact you if they have any questions about the invoice received.

3.1 Payment Terms

Invoices are due immediately. It is still advisable to add the payment terms on the invoice so that you do not have to wait too long for your money.

You should clearly specify the pay by date so your clients know the payment deadlines. Generally, you are free to decide on this payment deadline. However, it is very common to have a 7, 14 or 28 business days payment schedule.

Should your client not make the payment by the set deadline, you can send them an official payment reminder (known as a Mahnung in German).

Read here on how to send a Mahnung or Legal Payment Reminder in Germany

3.2 Payment Details

To avoid any further delays, specify your bank details or other information about payment details. You should add all the necessary bank details clearly.

If you prefer Paypal, then add your Paypal email id and the instructions. Never assume that your client may know how Paypal or other online payment systems work.

You May Also Like: How to easily file freelancer taxes in Germany

3.3 Unique Invoice Number

According to § 14 UStG, each invoice includes “a consecutive number with one or more series of numbers, which is assigned by the issuer of the invoice once to identify the invoice”.

Each invoice number must be unique.

That’s why you can not give the same invoice number twice. Furthermore, it must be a consecutive invoice number. So if your first invoice is 0012, the second and third invoices should be numbered as 0013, 0014 and so on.

3.4 VAT Charge Requirement

Not every invoice contains a VAT charge! You can charge VAT to your clients under some circumstances.

- The small business regulation (Kleinunternehmerregelung): As a small business owner earning less than

17.500€22,000 € per year, you do not have to pay VAT to the tax office. - Domestic tax exemptions: According to § 4 UStG there are some deliveries and other services that are explicitly VAT exempt. For example, these include the well-known tax privileges for health professionals, local transport or the post office.

- Cross-border deliveries of goods: Many exports are completely exempt from VAT. In the case of export deliveries, the VAT Law distinguishes between deliveries of goods to other EU countries and other foreign countries. There are also differences between business customers (B2B) and consumers (B2C).

- Cross-border services: The rules and exemptions for services for customers in other EU countries are particularly complicated. In doing so, services to final consumers are in principle subject to VAT. For business customers, the reverse charge procedure applies.

Read More About VAT in Germany: How to Charge VAT to Clients in Germany, EU and Non-EU countries

4. How to Write Invoices for Upwork Clients

If you regularly get clients on Upwork you may have noticed that Upwork invoices do not meet the typical German bookkeeping regulations (as described in the above section).

So you will have to extract information from your Upwork transactions and create a legal German VAT invoice that local tax authorities can recognise. Basically, include all the details that are required in a typical German invoice template.

But since you get paid via Upwork, you will add an additional note saying that ‘Payment made via Upwork on DATE’.

I have described this method in this short 4-minute video. It was recommended to me by my German tax advisor and I have never had any issues with Finanzamt.

5. Why So Many Rules?!!

Because…Germany! OMGLOL just joking 😉

Even if all that sounds pretty complicated, the legal requirements for an invoice make sense.

The information not only helps secure your VAT refund but also helps your customers or their accountants understand the invoices properly. In addition, the German tax office can quickly verify if everything is how it was supposed to be.

You will make your life easier by sticking to the requirements. After all, who wants trouble with the Finanzamt.

Anyway, now that you have some more information about German VAT invoices, go ahead and start creating your own!

6. How to Create a German VAT Invoice (For FREE!)

There are TWO ways to create your German VAT invoices.

6.1 Use a free accounting or invoicing tool

The right accounting/invoicing tool will automate the ENTIRE bookkeeping process for you – starting from generating offers, and contracts, creating VAT invoices and also automatically sending payment reminders and Mahnung to your clients (in case of late payments).

Accounting tools offered by German providers are completely compatible with German tax laws and can minimise the risk of expensive bookkeeping errors for you.

I have been using an invoicing tool from day 1 of my full-time freelancing. Considering all the manual work, time and headache it saves me, there is no way I would ever go without a proper accounting tool.

Sorted is a very simple all-rounder tool for freelancers in English and German. It also functions as an app on iOS and Android mobile devices. You can create free invoices with a free Sorted plan.

Click here to create a free invoice with Sorted

6.2 Use German invoice templates

If you are a freelancer with only a few clients, this may be a better solution. You will have to manually enter data and format it. While it is free of cost to manually create invoices, the risk of errors may be higher.

DOWNLOAD FREE GERMAN INVOICE TEMPLATES

You will find THREE versions of the German invoice templates.

- with VAT

- without VAT

- with VAT Reverse Charge

The files are completely editable and you can simply add your own details.

Have fun invoicing your clients and remember to enjoy a Weißbier once you get your payment! 😉

Click Here to Get Your FREE German VAT invoice Templates

17 Comments

mukund

Hello,

Quite a good blog for new comers to Germany.

Recently we started a GmbH copany in Solingen.

As you rightly ponted our we are quite excited about making an Invoice.

We have a customer in Belgium, and we want to make an Invoice for Services.

Do we need to charge VAT?

Secndly, we have hired a tax consultant who is charging us 100 euro per month + 1000 Euro per year. Is the charges justified?

Yamini

Hi there, Belgium is an EU country. In the EU a VAT reverse charge applies. So you would use a VAT reverse charge rule for this invoice. This is explained in more detail in this post: https://mademoisellein.de/how-to-charge-vat-as-a-freelancer-in-germany

As for the tax consultant fee, I’m afraid I cannot comment. It can vary greatly depending on the city, monthly volume of bookkeeping and skills and experience of the consultant.

Vibha dpaula

Hi Yamini,

Thanks for your inputs. they are very elaborative. i still have confusion on creating vat compliant invoice.

I reside in Dubai and I am providing services to a German company. Can you please help me understand how to prepare invoice.

Yamini

Hey Vibha, if you are a tax resident in Dubai, then you must look up the tax laws/ invoicing guidelines for Dubai. Good luck! 🙂

Yeonwoo

Hi, Yamini. Thanks for your YT video for invoicing and also for this post. I’ve been using Upwork for a couple of months and just realised that I have to prepare separate invoices to meet the Finanzamt regulations thanks to your amazing free contents. I really appreciate that.

I just wanted to ask a question if you don’t mind, while I’m in the stage of getting all the invoices straight via Sorted.. when you are making custom invoices, do you refer to the original Upwork invoice number? For example, there is one client from whom I have received payment three times over the course of a month. I produced one custom invoice for the client with three rows, one row for each payment with short description for what the payment was for. (I don’t think the listing of individual payment is absolutely neccesary, but it’s also for my own record) I stated clearly that everything is paid via Upwork, and I wonder if I have to include the original Upwork invoice number to my custom invoice to make it clear and attach the Upwork invoices when necessary, or if it doesn’t matter as long as things like client information and the costs are all correct?

I’m not sure if I’m gettings stressed over unimportant details or not, but I just want to get things as clear as possible when I’m still a beginning freelancer. And thanks again for your YT channel and the blog!!! It’s been more helpful than any free resources I saw until now regarding using Upwork and doing taxes.

Yamini

Hey Yeonwoo, Thank you very much, I’m happy that my content was helpful 🙂

Upwork’s data on invoices is basically useless for German accounting since they have their own invoicing system.

Finanzamt requires that all YOUR invoices must be sequential. If your last invoice of Sept was invoice #10, the first invoice of Oct must be #11 and so on. If you want to be extra cautious, you can add Uwork’s invoice numbers as additional info e.g. ‘Upwork reference number 123’ etc. Although I never did this besides the ‘payment made via Upwork on DATE’ remark.

Basit

Hi Yamini, Thanks for the nice info.

Two short questions for Kleinunternehmerregelung

1. 22000 Euros per year is the limit of turnover(total sales) or its the profit you earn?

2. If it is less than the limit, then VAT will be zero, and do we still have to mention VAT in the outgoing invoice?

Thanks in advance! Cheers

Yamini

Hey Basit,

1) VAT is charged on total sales not profits.

2) If you are registered as a Kleinunternehmer, you can write a message like ‘„Gemäß § 19 UStG wird keine Umsatzsteuer berechnet.“ or „Kein Umsatzsteuerausweis aufgrund Anwendung der Kleinunternehmerregelung gemäß § 19 UStG.“ and leave the VAT amount filed as 0,0 EUR.

I hope it helps 🙂

Yamini

Ori

the downloading link is broken so i couldnt download 🙁

Yamini

Hi Ori Can you please elaborate what error message you’re seeing? I just tested out the flow and was able to download the files. The downloadable invoices files go to your inbox.

Allie Hartmann

Hi Yamini,

Your blog has been so helpful!

I am currently in the process of applying for a freelance visa to teach English as a second language. Right now, I have an Aufenhaltsurlaubnis which only allows me to work as a full-time employee and most language schools only hire freelancers, so it has been a bit stressful but I am slowly getting it worked out. I already have two letters of intent from two language schools, which is good! I am waiting for an appointment at the immigration office, but they told me I need to have a business plan, is this true? And do you know if I am allowed to keep my Aufenhaltsurlaubnis once I get my freelance visa? I pray that my freelance visa gets approved. It always makes me nervous going to the Ausländerbehörde because I am so afraid they will ask for something that I’ve never heard of.

Anyway, thank you for sharing all your tips and tricks! It has been so helpful in my research <3

Allie

Yamini

Hi Allie, Thank you for your kind words 🙂 Really means a lot!

Yes, I was asked for a business plan. I think I still have it somewhere in my folders. If you wish I can send it to you via email. Just let me know 🙂

Regarding this – “And do you know if I am allowed to keep my Aufenhaltsurlaubnis once I get my freelance visa?”

– Freelance visa is a resident permit itself so you will continue to stay and work in Germany as a freelancer. I waited nine months for my visa process, I hope yours go faster. I remember how unnerving it was for me so I can totally empathise with you. It also helps to keep reminding ourselves that these things can take a long time in Germany.

Good luck with everything! 🙂 Yamini

Anika

Hi,

Thanks for the informative article. I wanted to know that, as a freelance photographer, do I have to pay a pension?

I have just started, and my income will be less than 450 € per month.

BR

Anika

Yamini

Hi Anika, Thank you! 🙂

Pension is mandatory for some specific freelance occupations. I don’t see photographers in this list. https://www.fuer-gruender.de/wissen/existenzgruendung-planen/branchentipps/freiberufler/rentenversicherung/ Please feel free to verify from this link (there are also many other sources, mostly in German though.

There’s also Rürup scheme for new or low earning freelancers in Germany. I working on a complete article covering pension for freelancers in Germany. If you want you can check this blog in a week or so 🙂

Lesley

Really clear and easy to follow info and templates – thanks a lot!!

Yamini

Happy to hear that Lesley, thank you! 🙂

Pingback: