6 Facts About Advance VAT Return in Germany (Umsatzsteuervoranmeldung)

Top Takeaways From This Post

Last updated on January 6th, 2023 at 07:26 pm

Are you a freelancer in Germany and charge VAT to your clients? Read this post to learn how to submit advance VAT return (Umsatzsteuervoranmeldung) in Germany.

Umsatzsteuervoranmeldung AKA advance VAT return or advance VAT reporting may sound complicated or even intimidating at first. But once you understand its nitty-gritty you will be able to deal with it – like a pro that you are 😉

Submitting advance VAT return, or Umsatzsteuervoranmeldung or UStVA for short is actually quite simple.

By the end of this article, you would have learned the most important facts about how advance VAT return works and the easiest way to file it.

Here are some commonly used German terms in this post and their English translations.

| German | English |

| Mehrwertsteuer/ Umsatzsteuer | VAT |

| Vorsteuer | Input tax |

| Umsatzsteuervoranmeldung (UStVA) | Advance VAT return |

| Umsatzsteuerbefreiung |

exemption from turnover tax |

| Finanzamt | Tax office |

| Kleinunternehmerregelung | Small Business Regulation |

| Umsatz | Sales/ Revenue/ Turnover |

| Besteuerung | Taxation |

| Sondervorauszahlung | Special advance payment |

| Säumniszuschläge | Late payment fines |

| Vorsteuerüberhang |

Input tax surplus |

| Steuererklärung | Tax return |

| Dauerfristverlängerung | Permanent extension |

1) What is advance VAT return AKA Umsatzsteuervoranmeldung (UStVA)?

As a registered freelancer in Germany, you are obliged to report VAT to Finanzamt from day one of your business.

Umsatzsteuervoranmeldung (UStVA) is the process of periodically reporting your incoming and outgoing VAT to your responsible Finanzamt.

By filing an advance VAT return, you basically make an advance payment of VAT to the tax office. It is very similar to quarterly income tax prepayments.

Since advance VAT return payments to Finanzamt are distributed throughout the year, your tax burden is spread out evenly. This prevents freelancers in Germany from paying a large lump sum payment at the end of the year.

2) Who must submit an advance VAT return in Germany?

Anyone who carries out a commercial or freelance activity in Germany must regularly submit an advance VAT return to the tax office.

There are three exceptions to this:

- Freelancers who are registered under small business regulation (Kleinunternehmerregelung). All self-employed persons who earn a turnover of no more than 22,000 euros in the previous year and do not exceed 50,000 euros in the current year are considered small businesses.

- Certain professional groups such as doctors, dentists, physiotherapists or insurance brokers are also exempt from sales tax and therefore do not have to submit an advance sales tax return.

- If your VAT liability was less than 1,000 euros in the previous year, you can be exempted from filing an advance turnover tax return after consulting the tax office. In this case, you only have to submit a VAT return once a year.

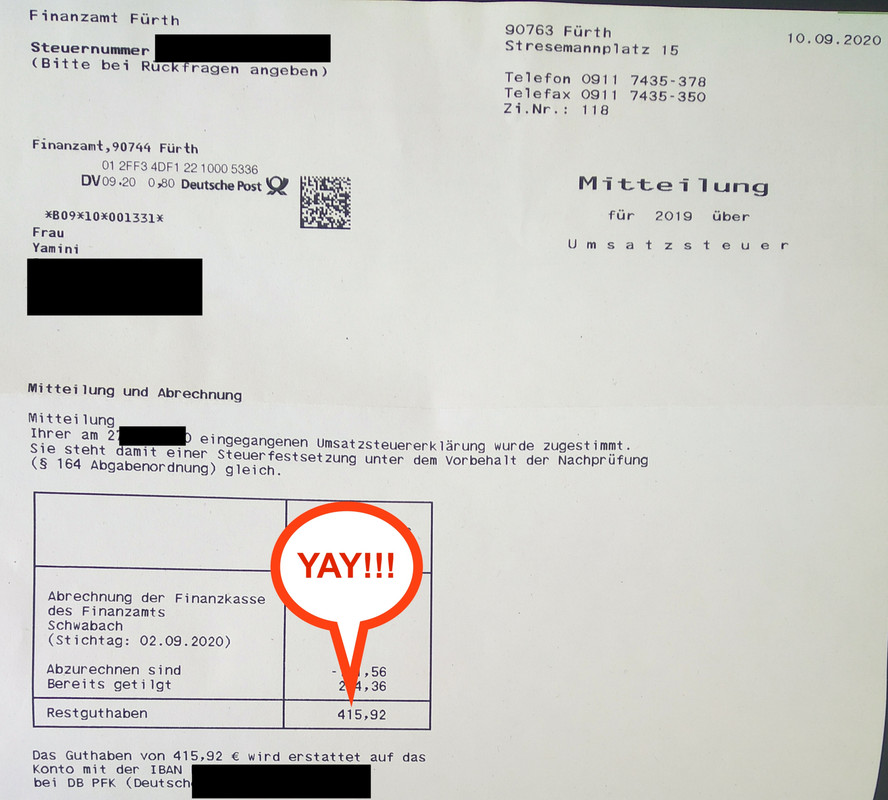

3) How is the advance VAT return calculated?

In short: VAT earned – VAT spent = VAT to be paid to the Finanzamt.

If there is a negative value, a so-called input tax surplus, you will be reimbursed by the tax office.

Most freelancers in Germany charge 19% VAT. A reduced rate of 7 % applies to certain types of services. If you are not registered as a ‘Kleinunternehmer‘ then you are obliged to charge your customers 19% VAT. You must clearly specify VAT in every invoice to send to your clients.

In addition to your income, as a freelancer, you may have business expenses on which you pay VAT. This is called Vorsteuer in German. It is important that the VAT is explicitly shown on the invoices.

4) What is the deadline for submitting an advance VAT return?

The advance VAT return must be submitted either once a month or once a quarter. The deadline is always the 10th of the following month. If you give the tax office a direct debit authorisation (SEPA–

4.1) Monthly advance VAT return

If you generate over € 7,500 VAT per year, then you will file a monthly advance VAT return. The advance VAT return must be submitted to the tax office by the 10th day of the following month.

For example, the advance return for tax on sales/purchases for January must be submitted by 10 February.

4.2) Quarterly advance VAT return

If you generate between €1,001 and €7,500 VAT then you will file a quarterly advance VAT return. The filing and payment date is then the 10th day after the end of the quarter.

For example, April 10 for the first quarter of a year. However, to submit the advance return for tax on sales/purchases quarterly, you need the express written permission of the tax office.

5) How to report advance VAT return to Finanzamt

The advance VAT can only be reported online. Submission in paper form is only permitted in exceptional cases and upon special requests.

You have TWO options for submitting your advance VAT return in Germany

- Do it manually with ELSTER: Either you go through all your income and expenditure for the advance return period, calculate the VAT collected and spent and enter all the figures manually, field by field, on the advance VAT return form in ELSTER Online.

- Do it automatically with just a few clicks: A much quicker and easier way is to submit it through dedicated software for freelancers such as Sorted. With a tool like Sorted, you can create the advance return for VAT in English and file it directly to your local Finanzamt.

Let’s take a detailed look at both methods.

5.1) Submitting Advance VAT return through ELSTER

Advance VAT return is submitted electronically to your tax office. You can do this via ELSTER, where you can complete the advance VAT return form. This form is about two pages long (and in German).

For this, you will also need an electronic certificate, which you can generate via the ElsterOnline portal. This certificate functions as a digital signature and guarantees the authenticity of your tax data.

A very complicated system, which only adds to more paperwork, stress, time and admin work.

5.2) Submitting advance VAT return through a tax filing tool

You can make it even easier for yourself to submit your VAT return with just a few clicks directly from a dedicated tax filing tool for freelancers such as Sorted.

Based on your income and expenses, Sorted automatically prepares your VAT report for the tax office. This way you can create and send your VAT return within minutes in just a few clicks.

You don’t even need an ELSTER certificate for this – Sorted sends the VAT reports directly to the tax office. In addition, you can manage all your invoices and expenses in one place and have an overview of your business finances at all times.

The UI of Sorted uses very simple English which makes it extremely helpful for expat freelancers who are uncomfortable with complicated legal or finance German terminologies.

Click here to sign up with Sorted and submit your VAT advance return in ENGLISH

One Comment

Pingback: