Best English Accounting Software in Germany (2024 Update)

Top Takeaways From This Post

Last updated on January 22nd, 2024 at 03:27 pm

Like most non-German speaking freelancers I have also suffered hair-pulling moments while managing my accounts and taxes. However, life got much better, once I found out that there are plenty of English accounting software in Germany. Here is a summary of some of the accounting software for freelancers in Germany that support multiple languages.

As a freelancer in Germany, you can totally get by manually creating VAT invoices for your clients. However, with the right accounting and invoicing software for freelancers, you can avoid costly mistakes, save valuable time in the boring soul-sucking admin work and stay on the safer side of the German tax authorities.

In this post, I have compared some popular invoicing tools and given some tips on choosing the right English accounting software in Germany.

Disclaimer: This blog post may include affiliate links. These links do not cost you anything but I might earn a small commission if you decide to order something from one of my recommended partners. Thank you for your support to help keep this platform growing!

1) Recommended English Accounting Software in Germany

An ideal invoicing and accounting software should automatically create invoices, monitor open invoices, compare them with incoming payments or create payment reminders or dunning letters for unpaid invoices. International freelancers with a German and global client base would also want multiple language compatibilities.

When reviewing invoicing and accounting tools available in Germany, I kept the following factors in mind:

- Compatibility with multiple languages, especially English – since you may not be a fluent German speaker

- Easy to terminate the contract since international freelancers may be in Germany for a short term

- Compatibility with multiple countries and geographic areas

- Ability to submit an advance VAT return to German tax authorities (Umsatzsteuervoranmeldung)

- GOBD and GDPR compliant

- User-friendliness and a clean user interface

- The extent of invoicing and accounting features

- Third-party apps and integrations

- Price and customer and tech support

Based on the above criterion, I chose the following four as ideal English accounting software in Germany for international freelancers.

Software/ Features | ||||

Trustpilot Rating (May '23) | 4.5/5 | 4.4/5 | 4.3/5 | 1.9/5 |

Language | EN/ DE | EN/ DE | EN/ DE/ ES/ FR | EN/ DE/ ES/ PT |

Invoice Generation | Yes | Yes | Yes | Yes |

Expense Recording | Yes | Yes | Yes | Yes |

Payment Reminders | No | No | Yes | Yes |

Profit & Loss Statement | Yes | Yes | Yes | Yes |

VAT Reporting (via ELSTER) | Yes | Yes | Yes | Yes |

Annual Tax Return (via ELSTER) | Yes | Yes | No | No |

Bank Account Integration | Yes | Yes | Yes | Yes |

Contract Flexibility | Monthly Cancellation | Monthly Cancellation | Monthly Cancellation | Monthly Cancellation |

Trial Period | Unlimited Free Account | Unlimited Free Account | 14 Days | 14 Days |

Starting Cost/ Month | € 20,00 | € 7,50 | € 8,90 | € 8,00 |

2) Invoicing Software in Germany For English Speakers

Here are some accounting and invoicing software in Germany at affordable monthly costs used by local and international small businesses and freelancers.

2.1) Basic Bookkeeping + online tax filing tools for international freelancers in Germany

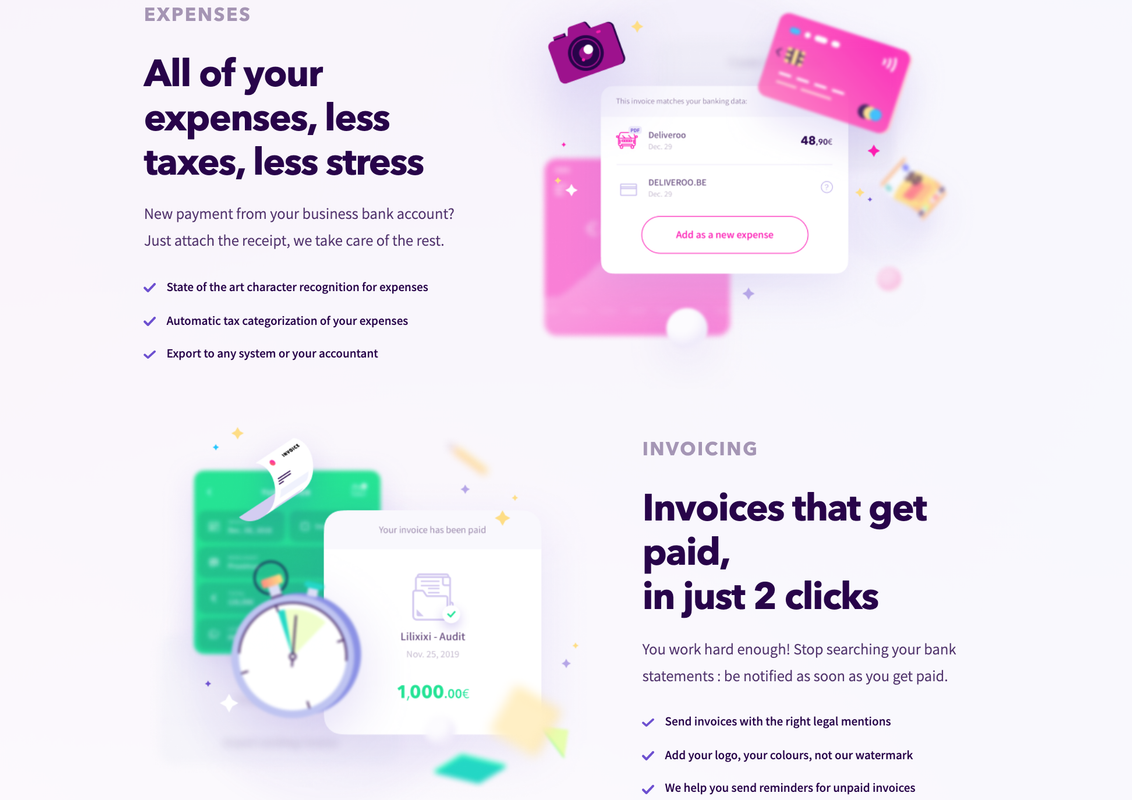

Accountable is a Belgium-based online tax and accounting tool, and now it is also available to freelancers in Germany. The best thing about Accountable is that you can also download it as an iOS and Android app making your business finances completely accessible from anywhere. It offers free as well as paid plans to accommodate freelancers with varying requirements.

With a free Accountable account, you can

- Register as a freelancer in Germany in English

- Create free invoices with legal mentions

- Export your data in a formatted CSV file

- Test various bookkeeping features for unlimited time

Accountable also offers an efficient way of connecting freelancers with accountants in Germany – completely on-demand and tailored to individual accounting and tax requirements. Freelancers who need professional help can choose their accounting services at a fixed cost, so they never have to worry about paying extortionate Steuerberater fees in Germany.

Language: English and German

Cost: Free plan with limited features. Paid plan starts at €7.50 per month.

Find out more about Accountable’s features here.

If you have relatively simple accounting needs then you will benefit greatly from Sorted. Sorted is an online tax filing tool created to serve the needs of English-speaking sole traders and freelancers in Germany.

With a paid Sorted account you can:

- Keep a track of your expenses and income

- Generate unlimited invoices within its UI

- File all your German freelancer tax reports in English – Income-tax return (Steuererklärung), Annual VAT return (Umsatzsteuererklärung), Annual profit report (EÜR), Advance VAT declaration (Umsatzsteuer–Voranmeldung)

-

Get on-demand help from a certified German tax consultant (at an additional but reasonable charge)

Language: English and German

Cost: Sorted’s basic invoicing, expense and income recording features are free for all users.

Kleinunternehmer can report their freelancer taxes for €80 per year.

Freelancers who report VAT monthly or quarterly can use Sorted’s Pro’s plan for €60 per quarter.

Click here to learn more about Sorted

Related: Dummy’s Guide to Freelancer Annual Tax Return in Germany

2.2) Invoicing tools for English/ multilingual freelancers in Germany

If you are a freelancer from one of the EU countries and would like accounting software in multiple European languages then here are some recommendations for compatible accounting tools.

sevDesk is German accounting software that allows users to switch between multiple EU languages. Its sevDesk Invoice plan includes automatic quotes and offers generation and invoice creation and payment reminders. SevDesk also has a mobile app and is excellent in terms of usability. Its accounting interface is very neat, compatible with DATEV export and offers a ‘tax consultant access’. An upgrade to the powerful version “sevDesk Accounting” is possible at any time. You can also cancel your account on a monthly basis.

Languages: English, German (DE, CH, AT), French, Italian, Spanish

Cost: You can start using sevDesk Invoice plan from €8,90 per month.

Click here to test SevDesk for free for 14 days.

Billomat is an invoicing and accounting program that supports the entire bookkeeping process. The “Billomat Business” version, is intuitive to use and offers all the functions from invoice generation to bookkeeping.

If you are looking for an invoicing program and would also like to do your own bookkeeping, Billomat is a great choice. Billomat’s Solo plan is perfect for freelancers and side hustles like bloggers.

Languages: English, German, Spanish, Portuguese

Cost: Billomat’s Solo plan starts at €8,00/ month

Click here to start a 14-day free trial (NO credit card details required).

2.3) Invoicing tools for digital nomads in Germany

If you are a digital nomad planning to stay in Germany for just a few months you don’t need to invest in a completely new German or EU accounting tool.

FreshBooks

FreshBooks is an international accounting and invoicing tool that can be used in multiple European languages and currencies.

FreshBooks UI offers an invoice generator that makes creating professional-looking and branded invoices ridiculously easy. It is very simple to create and customise invoices and add your business logo, payment terms and VAT rates. Besides basic invoicing, the tool comes with a number of robust accounting and bookkeeping features.

FreshBooks is also GDPR, PCI and PSD2 compliant, so you and your client’s data and privacy are safe and sound on their servers. If you want to try FreshBooks, they offer unlimited access to all features for 30 days. No contract and no credit card are required.

Languages: English, German, French, Italian, Spanish, Greek, Russian, Portuguese, Dutch and many more.

Cost: FreshBooks’ Lite plan for freelancers starts at $ 13.50 $6.00 per month.

Sign up for a 30-days free account here

2.4) Invoicing tools for English/German-speaking freelancers in Germany

Is Germany your forever home now? Maybe you are fluent in German but still prefer to use a tool compatible with English. Here are some German accounting tools that offer English translations as well.

The lexoffice “Invoice & Finance” invoicing plan offers a powerful package with good intuitive usability and mobile apps, and obviously a full-featured accounting suite. It can create offers, invoices, delivery notes, credit notes, payments, and most importantly, payment reminders.

Besides this, Lexoffice also offers integration with popular German online business banks such as Kontist and Holvi. This lets you can automate bookkeeping in real time. Other popular 3rd party apps such as Zapier, Paypal, Shopify are also available.

There is no trial period with lexoffice, however, you can easily cancel your services on a monthly basis.

Languages: German and English translations of invoices and other templates

Cost: Lexoffice’s ‘lite’ plan starts from €5,14/ per month

Click here to sign up for lexoffice

3) What to Consider Before Buying Accounting Software in Germany

As you can see from the above section that there are tons of accounting and invoicing software in Germany. Here are some of the features that you should carefully consider when investing in bookkeeping software.

But how do you know if you really need an accounting and invoicing software in Germany?

Well, that depends on your business situation.

- Is your client base growing fast?

- Do you have to create multiple invoices each month?

- Do you have to register VAT every quarter?

- Do your clients pay late and force you to send them payment reminders and Mahnung?

If you answered YES to all of the above, then trust me an accounting tool will make your life as a freelancer in Germany so much easier. Plus it’ll be lighter on your pockets as you could save hundreds if not thousands of euros in an accountant’s fee per year.

Here are key features to look for in ideal accounting software in Germany

It should fit your requirements: If you are a freelancer with only a handful of invoices and expenses per month there is no need to get a fully-featured bookkeeping tool. A starter plan suitable for busy freelancers should suffice. On the other hand, if you are selling digital products or running an e-commerce business, then you may need some additional features to manage and organise all the transactions.

It should have an intuitive user interface: Accounting is already a complex part of running a business. The last thing you need is a UI that complicates the process even more. An ideal invoicing and accounting software should take work off your hands and save time. Therefore its user interface must be intuitive and easy to learn.

It should be scalable and ‘upgradable’: As your business grows, the demands on billing software will also increase. You should take this into account when buying the software.

It should have robust data protection features: Your accounting software often doubles up for managing customer data (CRM). Since so many invoicing and bookkeeping software solutions are available as SaaS, you should attach great importance to data security.

It should offer data backup and recovery: Any accounting software contains very important information which is relevant from a tax point of view. In Germany, you are required to maintain financial records for several years. Before buying invoicing software in Germany, make sure that the provider offers regular data backups and restoration in case of an accident.

It should offer an ideal price/performance ratio: Although most well-known accounting software has very similar features, you should take a close look at the costs of the functionalities offered. This point becomes particularly important when upgrading from basic to ‘pro’ versions.

It should have excellent (and fast) customer support: If there are problems with the invoicing software, timely support from the provider is important. Please check whether a service hotline is offered and what costs may be incurred.

It should have a free trial phase: A test drive is a must before you commit to buying accounting software in Germany. Take advantage of a free trial period and test the billing programs that are on the shortlist.

It should offer a knowledge base or/ and onboarding: Although many invoicing tools can be operated intuitively, the accounting software provider should also offer a comprehensive knowledge base or an onboarding program for first-time users.

It should have GOBD conformity: Any invoicing software in Germany must comply with German legal requirements. For example, the storage periods of 10 years, the completeness of the documents and the non-manipulability of created documents, especially the invoices are crucial in German tax laws. Check and re-check if the accounting software of your choice conforms to these regulations.

Read More: English Online Tax Tools For German Expat Tax Return (That cost Under €50!)

So here is my summary of the best English accounting software in Germany. Do you use some other tool for your invoicing and accounting? Tell us in the comments below!

12 Comments

1billionlinks

Having read this I believed it was very informative.

I appreciate you finding the time and effort to put this informative article together.

I once again find myself spending way too much time both reading and leaving comments.

But so what, it was still worthwhile!

andrea

I am super confused by this. I have Lexoffice and I absolutely hate it. It’s not in English, it’s horribly inflexible and you can’t edit things. And I still cannot do anything I want. I only got it becasue it’s compatible with Kontist, my business banking app.

Yamini

Hey Andrea, Sorry to hear this. That’s correct the primary language of Lexoffice is German (which is why it’s placed in the German tools section). It does however have English translations that can be customised.

TreLeoni

As somebody being affected by Wave closing their business to businesses outside of the US and Canada, finding your site has been a rela helpful. Living in Germany but offering consultancy to mainly non-German companies I’m just looking for a easy to use no fuss application. Sure one of your recommendations will fit just fine. Apprecaite your time and effort collating this. Thank you.

Yamini

Hi Leoni, I’m very happy to hear you’re finding the blog helpful. 🙂 Thank you for the kind words!

Craig Cloete

Hi Yamini

Thank you for the article about English accounting software in Germany. It was very interesting.

I initially jumped in and signed up with Quickbooks (the accounting package I use for my business in South Africa) only to find out that even though it is sold in Germany, there is no German language option. It is also not able to integrate with DATEV without a 3rd party migration tool. (This is the software that all German Tax consultants use.)

I will definitely look at your suggestions and switch to one of them. Keep up the good work.

Yamini

Hello Craig, Thank you very much. I am glad that this post was helpful for you 🙂

Payroll services Whangarei

Thank you for this suitable article about English accounting software in germany, it will help me and people like me looking for the same. I appreciate your effort for taking time to do your research and present these details before us. Really nice way to present this content, very appreciative!!

Julius

Hello

Thanks for the information. Its very nice..

I am looking for a accounting software for my PC that should be installed and independent from the net. That is all accounting should be stored on the net and not online.

Can you help.

Thanks

Julius

Yamini

Hi Julius, I have this tool for my windows osx – http://www.softwarenetz.de/rechnung.php?setlang_id=com

You can download it in your system. It works offline plus you buy it upfront like old school software. 🙂

jim

Your site is so clean, clear & simple, it’s a gift ! I have been living in Germany for a long time now and still find most sites tedious (ADHS lass grüssen 🙁 ). You’re a blessing.

Yamini

Hi Jim, Oh wow thank you so much!! 🙂 ADHS? Greetings from fellow ADHS sufferer 🙁