Tax Tips For Bloggers in Germany – How to Tax Your Blog Income Like a Pro

Top Takeaways From This Post

Last updated on January 9th, 2023 at 04:51 pm

Are you a blogger living in Germany earning an income from your blog? If yes, then you will need to know how to tax your income correctly as a blogger. Read these tax tips for bloggers in Germany.

If you have been blogging for a while, you would know how long it can take until the first € is earned through a blog.

So if taxes on your blog income have become a relevant topic for you – a BIG congratulations to you! 😉

Whether it’s ad revenue or fees from sponsored posts, or gifts in kind from brands- your blog is now a source of income. In this post, you can read about some tax tips for bloggers in Germany and how to tax your income correctly.

Want to run your own professional website?

Let’s start right from the beginning.

1. When is Blog Income Considered for Tax Purposes

If you have a full-time job and blogging is your second job, then your blog is considered a secondary source of income (selbstständige Nebentätigkeit). The profit from secondary income is subject to the usual income tax liability in Germany.

Depending on the type of blogging activity, it is will be either a commercial/trade or freelance.

As long as you run a blog as a private person, and it does not lead to any income, business registration is not required.

2. Register Your Business as a Blogger

In Germany, you have to register ANY activity that creates monetary profits- that includes blogging.

Even if you only want to cover the web hosting costs of your blog with affiliate links or Google AdSense, you are no longer considered a hobby blogger.

As soon as the pennies start rolling in from your blog, you slowly start inching towards the tax territory. Therefore, it is best you register your blog as a business to avoid unnecessary warnings and expensive penalties from the Finanzamt.

The so-called unofficial trial period is usually 3 months. During this time you can figure out whether your blog really works out financially. If you register your business too late and have been making legit money on the side, you can expect to receive a warning or fines from the local tax authorities.

Related: How to Register Your Self-Employment in Germany

2.1 Determine Whether You’re a Trader or Freelancer

This is the tricky bit.

Depending on the profession, self-employment is either classified as a trade or a freelance activity. The freelancers include certain ‘catalogue professions’ that are precisely defined in § 18 EStG.

In addition to doctors and lawyers, these include scientific, artistic and literary as well as educational activities. It is therefore important to check whether your blog falls in a freelance category.

For example, if you work as a lecturer and write about the content of your teaching activities on your blog, you could be considered a freelancer.

Bloggers in other niches may need to register as sole traders. So if you are a lifestyle or an expat blogger earning from affiliate links or ads, you will most likely fall into a ‘sole trader’ category.

Related: Are you a Freiberufler, Freelancer or a Trader in Germany?

2.2 Registering Your Blog as a Business

You can register your blog as a trading activity at your local trade office (Gewerbeamt).

It costs about 30 to 40 euros. If you have already made money as a blogger, you have three months to register your business. By registering your business, you automatically become a member of the IHK.

After your registration, the tax office will send you a questionnaire for tax registration, in which you indicate, among other things, your expected income.

If your blogging activity falls under the Freiberufler category, then read this post on how to register your freelance business in Germany.

Get Professional Liability Insurance as a Blogger from Hiscox!

3. Tax Allowances for Bloggers in Germany

3.1 Small Business Rule (Kleinunternehmerregelung) for Bloggers

As a small business owner, you do not have to pay the VAT (sales tax). You can choose the small business regulation (Kleinunternehmerregelung) if your blog income did not exceed 22,00 euros in the last calendar year.

If you make a turnover of more than €50,000 in a calendar year, you will be liable to pay VAT immediately from that date.

It is extremely important to follow these regulations right from the start, as this is the only way to avoid expensive additional payments at a later date.

Related: Learn more about Kleinunternehmerregelung or Small Business Rule in Germany

3.2 Tax Thresholds for Blog Income

The tax-relevant threshold for income as a blogger does not differ from other types of income. The basic tax-free allowance in Germany is 9,168 euros in 2019. This limit has increased to 9,408 euros in 2020 9,744 euros in 2021.

3.3 Tax Exemptions for Blog Side Hustles (selbstständige Nebentätigkeit)

As long as your primary income comes from your full-time employment, you will only have to pay tax on your blog income if your monthly annual profit exceeds 410 Euros. This means your blog earnings will be tax-free as long as it is less than €410 per month year.

Related: How to Protect Yourself Legally and Financially as a Business Owner in Germany

4. Types of Taxes for Bloggers in Germany

4.1 Income tax

The income tax is important from the beginning. There is a tax-free amount of 9.744 euros that does not have to be taxed. If you earn more than 9.744 euros in profit within a calendar year, you must expect a tax rate between 14 and 42%.

Every self-employed person must prepare and submit an annual income tax return. The deadline for submitting the income tax return is usually 31 May of the following year.

4.2 Value-Added Tax (VAT)

Apart from income tax, VAT is the largest tax burden for most self-employed people in Germany. As a rule, VAT rates are 19% in Germany. If you have chosen the small business regulation (Kleinunternehmerregelung), you do not have to pay sales tax.

This has its advantages and disadvantages:

Disadvantage: You cannot reclaim VAT on goods and services purchased. This can mean a cost disadvantage if you earn your money with advertising and affiliate marketing. For many advertisers (your customers) it is irrelevant whether you show VAT on the invoice or not.

Advantage: As a small business owner, you save yourself the effort of the VAT advance returns (Umsatzsteuervoranmeldungen). Compared to some advertisers (e.g. doctors, insurance companies), it is also an advantage not to have to show VAT, as they themselves cannot deduct input tax.

Value-added tax is a very complex topic, especially where multinational businesses are involved (as is the case with blogging). Therefore, it is always better to consult a tax advisor before filing your taxes yourself.

4.3 Trade Tax (Gewerbesteuer)

For trade tax (Gewerbesteuer), a tax-free allowance of 24,500 euros applies to sole proprietorships and partnerships. The trade tax is due only when your profit from your blog exceeds the tax-free threshold.

Related: How to (Easily!) DIY Your German Freelancer Taxes

4.4 Taxation of Gifts in Kind (Sachgeschenke)

First off, a gift in kind is only tax-free if its cost does not exceed €10 Euros.

Blog income often includes “monetary benefits”. As a blogger, you can quickly fall into the tax trap here.

It is not unusual for companies to send their products to bloggers for reviews. Maybe a cosmetics company wants you to write about their new cream on your beauty blog. Or a hotel offers a free overnight stay to a travel blogger.

Such gifts are not considered as ‘gifts’ in the tax law sense, as they were not given free of charge. Rather, tax law describes the transfer of objects in expectation of consideration as a “monetary advantage”, or as “acquisition against payment”.

This is because the “gift” is equivalent to the remuneration of service – and these are therefore taxable in the same way as normal fees.

5. How to Report Your Blog Earnings to Finanzamt

Any income exceeding 410 euro per year will oblige you to report your profit or loss to your local Finanzamt.

You must declare this in the statement of income and expenditure. In this statement, you must list all the income from your blogging activity and compare it with your expenses incurred in the course of your blogging activity.

This includes, among others, hosting fees or the technical equipment for running your blog. You then subtract the expenses from your income as a blogger to determine your profit.

Related: Top Business Expenses for Self-Employed People in Germany

As a blogger, you earn income from multiple sources. Over time, bookkeeping and accounting can get quite complicated. The same for the annual income, VAT and trade tax returns and/or the monthly advance VAT reporting and 100 other tax-related things.

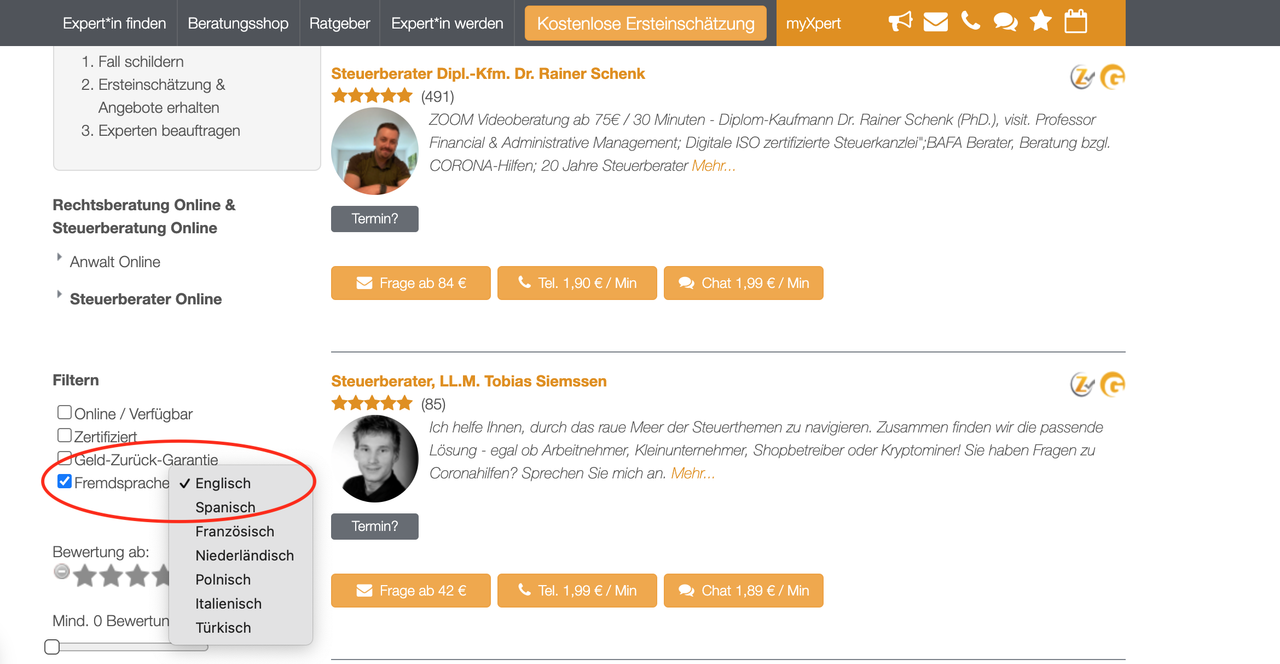

You can use a service like YourXpert.de. to find an English-speaking tax consultant.

This platform is officially in German, however, you can easily filter the tax consultants by using their language filter. As you can see in the image below, they support quite a few European languages.

Click here to find an English-speaking tax consultant in Germany

Obviously, there is no obligation to hire a tax consultant, but they can make life so much easier. But hiring a tax consultant in Germany can also cost a leg and an arm especially if you are a baby business.

So what are your alternatives?

6. DIY Tax Tips for Bloggers in Germany

So what are the budget-friendly alternatives to filing freelancer taxes in Germany?

In two words – get Accountable!

You can use Accountable if:

- You are a freelancer in Germany

- You are a sole trader selling goods

- You are registered as Kleinunternehmer in Germany

- You prefer to file your German freelancer taxes in English

- You want to reduce your accounting and bookkeeping costs

Accountable will single-handedly takes care of ALL stages of being self-employed in Germany:

- It guides you through your registration process as a freelancer with your local Finanzamt

- It helps you keep a track of your expenses and invoices

- It helps your file your Income-tax return (Steuererklärung), Annual VAT return (Umsatzsteuererklärung), Annual profit report (EÜR), Advance VAT declaration (Umsatzsteuer–Voranmeldung)

-

It also gives you access to on-demand help from your dedicated tax consultant at additional but reasonable costs

Click here to try out Accountable for FREE

Or watch this quick video walkthrough

Here are my tax tips for bloggers in Germany. Are you a blogger living in Germany earning an income from your blog? If yes, then let us know how do you tax your income correctly as an expat blogger.

Disclaimer: This page may include affiliate links. They do not cost you anything but I might earn a small income if you decide to use one of my recommended partners. Thank you for your support to help keep this platform growing!

11 Comments

Praveen

Hi Yamini,

That was an useful introduction for blog taxes. I am working and living in Germany. I have 2 questions

1. I run a travel blog where I share my travel experiences. Does this mean that I can also include the flights, hotels and other expenses related while filing the income tax? Because these are also the part of the business. If the answer is YES, then the second question applies.

2. I also have a full time job. So this flight expenses can be combined with the regular job expenses? Or is the regular job and blogger expenses are seperate?

Regards,

Praveen

Yamini

Hey Praveen,

1) If the flights are exclusively for your blog’s content then yes, it is a business expense. Bear in mind that Finanzamt can decide otherwise if they are not convinced.

2) Business expenses go in your EÜR (profit and loss statement). They are ONLY related to your business. You cannot deduct it as your ’employment-related expense’. This category is for annual tax returns.

Please read this for a fully detailed explanation of the self-employment tax reports. https://mademoisellein.de/guide-to-german-freelancer-taxes

Kate Williamson

Hi Yamini,

Thank you for the great share, really helpful. I believe blogging is a hustle and if anyone is looking for a tax advisor, bookkeeping and accounting services, try Weinhandl once.

Colver Long

Love this! Thank you for sharing!

YI

Hi Yamini,

First of all, thanks a lot for this great article, and all others – it is amazing how helpful are they.

I would like to ask you an important question to which I haven’t found answer till now based on my research in google – how do I deal with copy rights on a blog in Germany? How do I protect my copy rights on all articles?

I would really appreciate your thoughts on this, since you already have experience!

Thanks!

Yamini

Hey Yi,

Thank you very much, I’m glad you found the blog helpful.

I’ve also been researching on Copyright related information. It’s actually quite complicated and falls in a grey area. Media such as images or videos are easy to protect under copyright laws. However, website text or source code a bit difficult unless someone just copy-pastes everything to their website and claims it as their own work.

Here is an informative article on this: https://www.urheberrecht.de/website/

Duck Creek Street

This ALMOST makes me regret going back to blogging. Between this, Impressum, and Datenschutz I am a bit overwhelmed, but it’s all worth it right… right?

I will definitely be checking out Sorted. Thank you!

Yamini

Ah, tell me about it! 😀 Good luck with the new blog. I’ll be sure to check it out. And yes, I can highly recommend Sorted, I’m one happy customer!

Isana

Hi Yamini,

Thanks for this post! I just came to blogging after a 6 year break and it’s my first time doing it in Germany. I am one month in (still testing out affiliate links and where I want to go with this), but now I feel I should probably hold off getting my domain and making money off Ad Sense for the first 6 months or a year.

I do file my own taxes and love how easy it is (pretty straightforward as an employeed Category I individual) . Since blogging will be a side hustle, I’ll have to show it as selbstständige Nebentätigkeit and register myself as a freelancer – not sure if I should do that before I get my Niederlassungserlaubnis..

Wahib

Hi Yamini. Pretty useful article and very likely the only one I found on this topic of blogging as a side hustle in Germany.

I still have some important follow up questions and I’ll really appreciate if you could maybe respond via email.

1) It is still not clear to me that if I am earning less than 410 euros/month limit from the Blog, should I still register as a “freelancer” or a “business”? Because, if I don’t need to declare the tax then why should I bother registering? Considering, primary income comes from full-time employment.

2) I occasionally write on medium on various topics. I wanted to experiment with their paywall option so wanted to check taxation first. Does it make me a “freelancer” or “trade”? I won’t be writing about any one topic and won’t be writing all articles to be paid.

Thanks in advance.

Yamini

Hey Wahib, Thanks for the comment. 🙂

1) In the words of my Steuerberater, every cent earned in Germany (or even abroad!) must be reported to Finanzamt. Once you start generating income you are expected to register yourself as a business as it’s no longer a ‘hobby’ blog.

2) The status as a Freelancer or Trader depends on the type of activity and your field. I have covered this in more detail in another article if you are interested. https://mademoisellein.de/are-you-a-freiberufler-freelancer-or-gewerbe-in-germany

I would recommend consulting a Steuerberater who is familiar with the digital space and income generated from multiple sources.